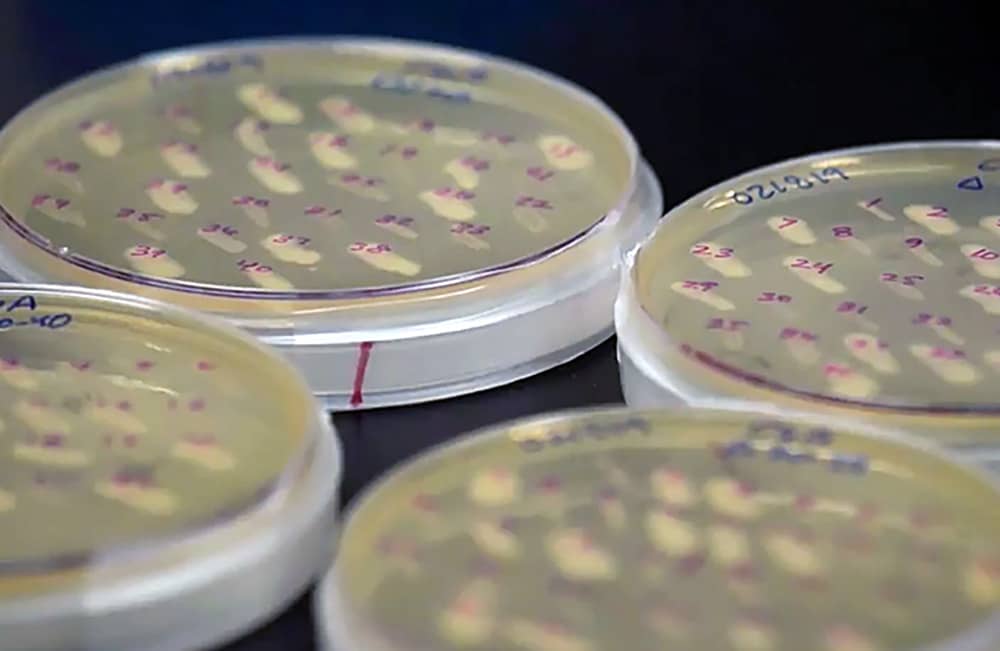

Pluton Biosciences created safe and effective pesticides from microbes to target specific pests, including those that are resistant to current products.

By bridging the gap between cutting-edge startups and market adopters, IN2 accelerates real-world implementation and scaling of transformative technologies in the built environment and infrastructure sectors.

Explore opportunities to collaborate with IN2 and drive impactful innovation, from startup development to large-scale implementation.

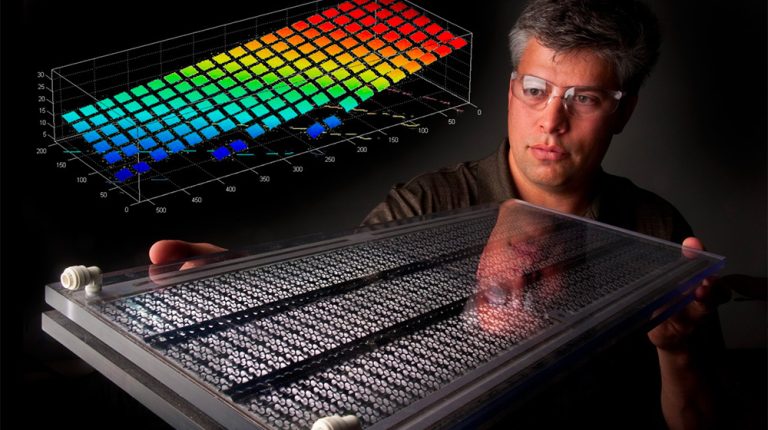

February 25, 2025 - Funded by the Wells Fargo Innovation Incubator (IN2), Yotta Energy installed its PV-coupled decentralized battery storage on the National Renewable Energy Laboratory (NREL) Café roof. These efforts showcase NREL's campus as a living lab to evaluate promising technology before full-scale deployment. (Left to right) NREL Solar Performance in the Field (SPF) technician Joshua Parker making final connections to the instillation. (Photo by Gregory Cooper / NREL)

February 25, 2025 - Funded by the Wells Fargo Innovation Incubator (IN2), Yotta Energy installed its PV-coupled decentralized battery storage on the National Renewable Energy Laboratory (NREL) Café roof. These efforts showcase NREL's campus as a living lab to evaluate promising technology before full-scale deployment. (Left to right) NREL Solar Performance in the Field (SPF) technician Joshua Parker making final connections to the instillation. (Photo by Gregory Cooper / NREL)

June 26, 2025 - Funded by the Wells Fargo Innovation Incubator (IN2), Transaera began work with NREL to validate its advanced dehumidification system that addresses the energy-intensive nature of air conditioning in humid climates. (Photo by Josh Bauer / NREL)

June 26, 2025 - Funded by the Wells Fargo Innovation Incubator (IN2), Transaera began work with NREL to validate its advanced dehumidification system that addresses the energy-intensive nature of air conditioning in humid climates. (Photo by Josh Bauer / NREL)stories

December 16, 2025

In January 2025, the Wells Fargo Innovation Incubator (IN2) chose seven winners for its ninth Channel Partner Strategic Awards cycle. The funding provided from this award addresses commercialization gaps for energy startups through action-oriented initiatives, regional collaboration, and knowledge sharing. Many awardees focused on creating partnerships and pilot opportunities by Read More

news

December 09, 2025

BUSINESS WIRE—The Wells Fargo Innovation Incubator (IN2), a $55 million energy technology program funded by Wells Fargo & Company and coadministered by the U.S. Department of Energy’s National Laboratory of the Rockies (NLR), formerly known as NREL, today announced the eight members of its second Scalable Tech track cohort. Each organization Read More

stories

December 01, 2025

Yield Lab Institute To Lead the H.A.R.V.E.S.T Accelerator With Same Successful Model The Wells Fargo Innovation Incubator (IN2) is known for its “secret sauce”: equal parts technical assistance, ecosystem support, and nondilutive funding. On Sept. 10, 2025, IN2 shared that recipe with the Yield Lab Institute (YLI) to launch its Read More

Pluton Biosciences created safe and effective pesticides from microbes to target specific pests, including those that are resistant to current products.

Robigo develops precision microbial treatments designed to improve plant health and recover lost yields by shaping how microbes interact with crops.

In its tenth year, IN2 did not pause to celebrate—it expanded its impact. The program launched a new adoption-focused track while continuing to support startups developing cutting-edge energy technologies.

Read the 2024 annual report to learn about the IN2 program and the successes of its portfolio companies and Channel Partners.

The quarterly newsletter from NLR’s Innovation and Entrepreneurship Center (IEC) offers timely updates on program information, news from portfolio companies, and upcoming events.

For startup-specific funding opportunities and resources, subscribe to IEC’s startup bulletin.